H1b tax calculator

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. New Jersey State Tax Quick Facts.

Tax Refunds Of Nonimmigrant Workers In The Us Taxes For Expats

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable.

. Estimate your tax withholding with the new Form W-4P. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Because tax rules change from year to year your tax refund.

Your average tax rate is 1198 and your. Thats where our paycheck calculator comes in. The standard FUTA tax rate is 6 so your.

Taxes in New Jersey. First enter your Gross Salary amount where shown. And is based on the tax brackets of 2021.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Generally an alien in H-1B status hereafter referred to as H-1B alien will be treated as a US. You have nonresident alien status.

Using the United States Tax Calculator is fairly simple. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. See where that hard-earned money goes - with Federal Income Tax Social Security and other.

South Carolina Income Tax Calculator 2021. If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409. That means that your net pay will be 45925 per year or 3827 per month.

Your average tax rate. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Your household income location filing status and number of personal exemptions. Next select the Filing Status drop down menu and choose which option applies.

Resident for federal income tax purposes if he or she meets the Substantial. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

The federal tax for H1B employees ranges from 10 to 37. If you make 55000 a year living in the region of Texas USA you will be taxed 9076. 242 average effective rate.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. If you make 55000 a year living in the region of New York USA you will be taxed 11959. On an H1B visa you have to pay Federal State Social Security and Medicare tax based on your income.

If you become a US resident you will have access to those deductions but you will also be charged on your worldwide income. It is mainly intended for residents of the US. Your income level determines the tax rate which.

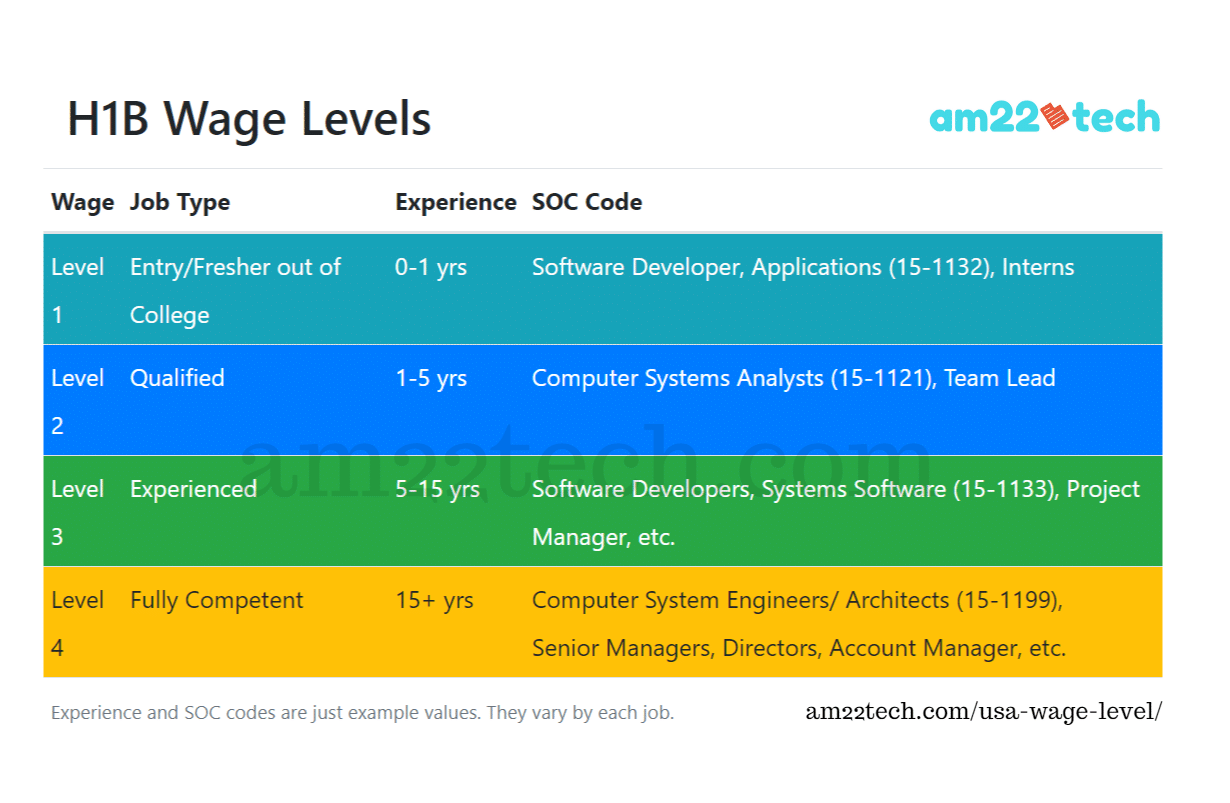

Ad Discover Helpful Information And Resources On Taxes From AARP. Prevailing Wage Level Calculator for H-1B H-1B1 E-3 and H-2B Visas and PERM Labor Certification. Your average tax rate.

May not be combined with other. That means that your net pay will be 43041 per year or 3587 per month. Texas Sales Tax.

Your household income location filing status and number of personal.

Am22tech Usa Australia Canada Immigration Visa Money Green Card Application Visa Academic Essay Writing

Chances Of H1b Approval After Lottery 2021 22 Denial Rfe Steps Usa

Us Tax Filing 2022 For 2021 H1b L1 H4 L2 Updates Deadline Rates E Filing Redbus2us

Can I Downgrade To Lower H1b Wage Level Lca Pwd Risks Usa

6 Types Of Taxes Every H1 B Visa Holder Pays In The Us Aotax Com

Total H1b Registrations Received For Fy 2021 Is 275k 46 Masters Redbus2us

Texas Paycheck Calculator Smartasset

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

This Is How Much Money You Save On H1b L1 Visa In Us 2022

H1b Salary Comparably

Can H1b Work From India Canada And Get Salary In Usa Usa

How Will The New Tax Reform In The Us Benefit People On H1b Quora

How Much Will I Pay In Income Tax While Working On An H1b In The Us

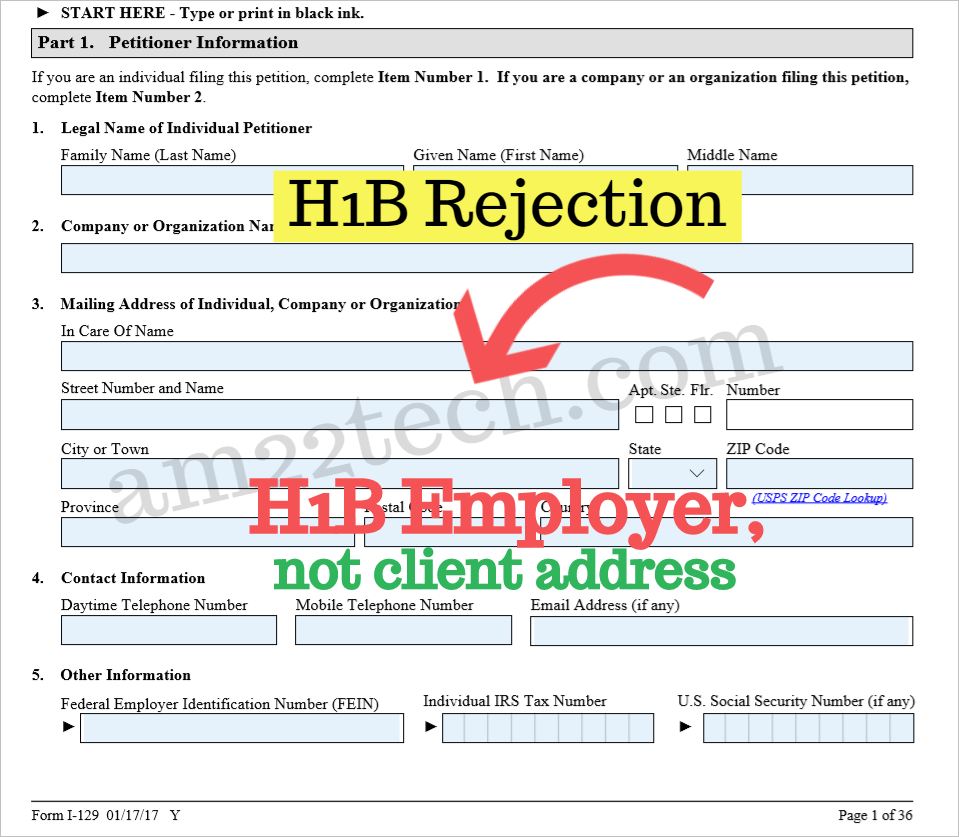

Uscis Will Reject H1b Without Employer Primary Us Office Address Usa

This Is How Much Money You Save On H1b L1 Visa In Us 2022

Missouri Income Tax Rate And Brackets H R Block

Filing Taxes On H1b Visa The Ultimate Guide